Advancing the conversation on land and real estate issues in BC.

Insight: REIBC blog > Two New Taxes

|

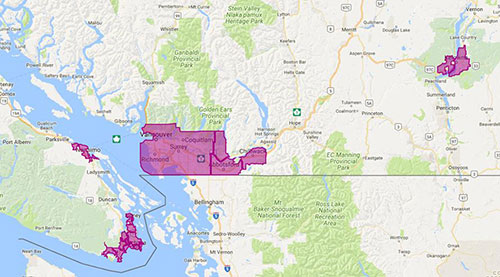

Taxable regions for BC’s new speculation tax. Credit: flickr/Province of BC

|

Affecting property owners, two new taxes in BC become payable in 2019: the speculation and vacancy tax and the additional school tax. Released on February 20, 2018, in the provincial budget, these taxes are intended to curb BC’s housing crisis by helping to build affordable housing.

“The BC Government claims that it has designed the speculation tax to ‘prevent housing speculation and help turn vacant and underutilized properties into homes for people who live and work in BC,’” explains Ed Furlan, RI, of Altus Group Vancouver. “According to the government’s website, the aim of levying the highest tax rate on foreign owners and satellite families is to ensure that those with limited social and economic ties to the province pay the largest share of the tax.”

The speculation tax applies to residential property within specific regions identified by the Province, and exceptions can be found within the regions. School tax was already being collected from BC property owners via annual property tax notices. However, an additional school tax will now be applied to most high-valued residential properties.

“The BC Government has estimated that the additional school tax will generate $250 million in tax revenue over the next three fiscal years. The government believes that within the province, residential properties have appreciated dramatically in the last decade, specifically those in the Metro Vancouver region,” says Furlan. “Therefore, there have been “additional resources” that have been gained from those properties. In other words, the government has introduced the additional school tax because it believes those property owners can afford to pay a little bit more to provide support to help build affordable housing.”

|

| Download Spring 2019 |

Read more about the taxes, where they apply, and their impact in Furlan’s “Regulatory Changes Bring Two New Taxes” in the Spring 2019 edition of Input. Download Spring 2019

Join the conversation on Facebook